cap and trade system vs carbon tax

Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. Stavins Harvard Kennedy School abstract There is widespread agreement among economists and a diverse set of other policy analysts that at least in the long run an economy-wide carbon-pricing system will be an essential.

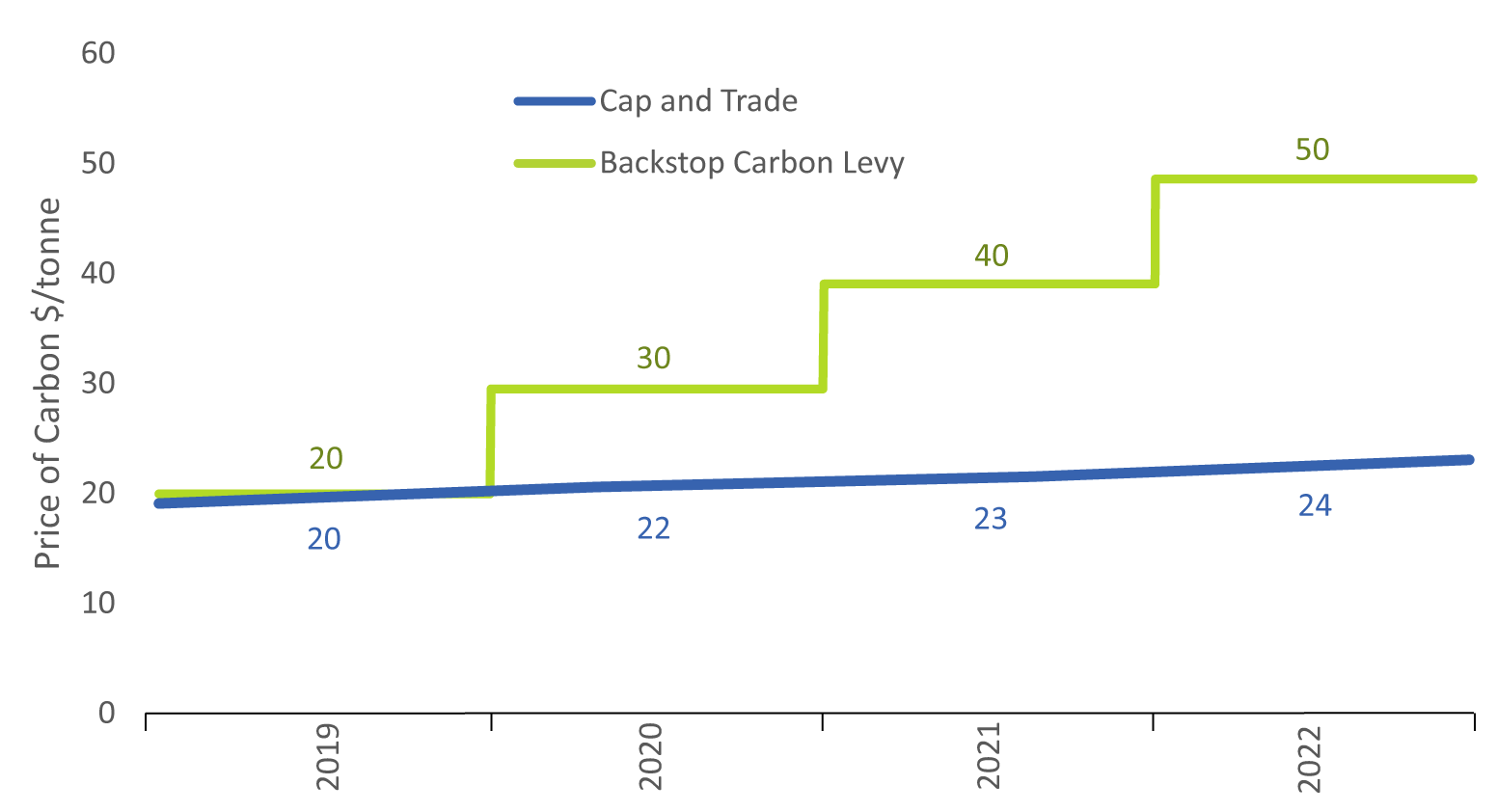

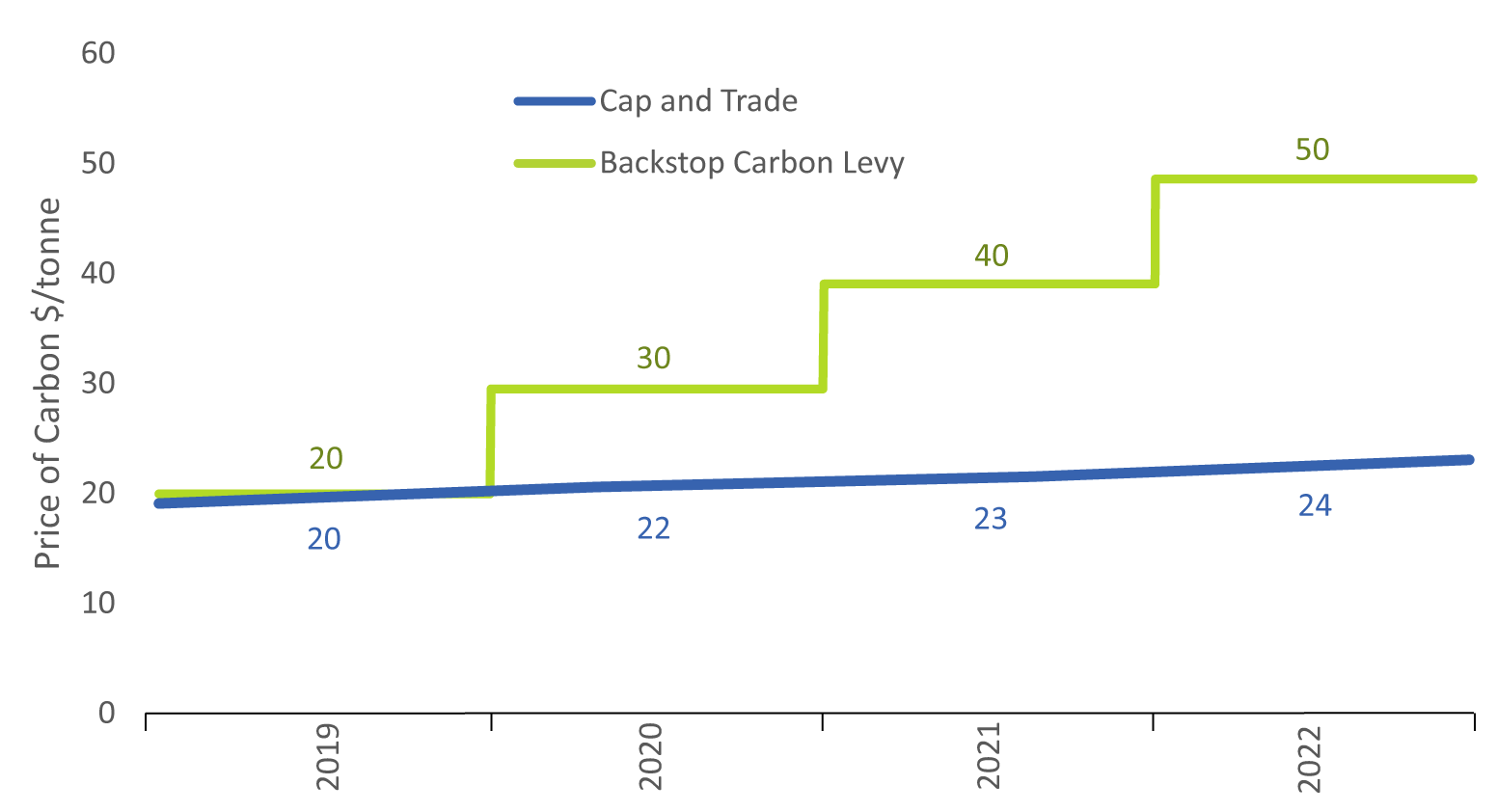

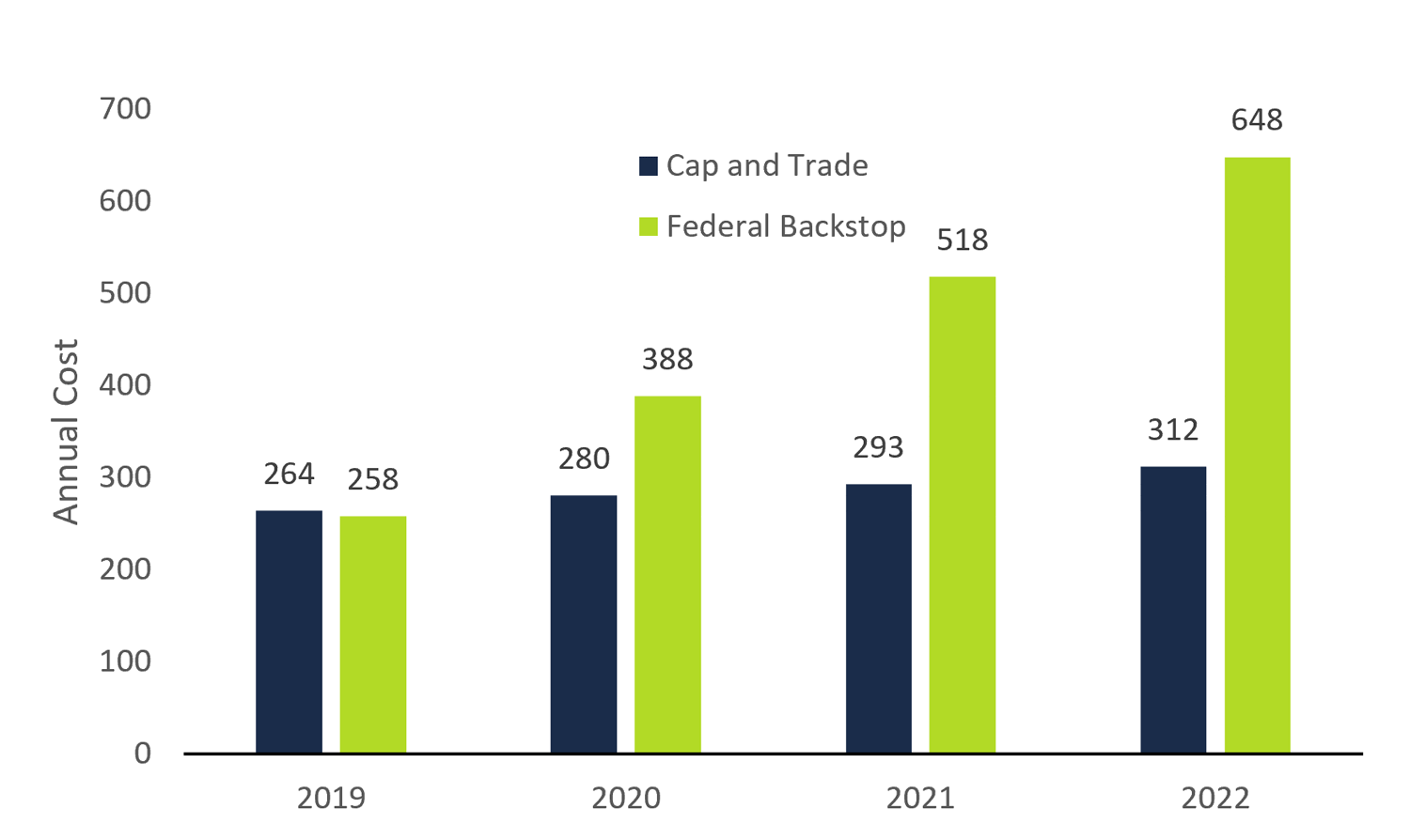

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

If the European Unions Emission Trading Scheme ETS accomplishes.

. They lean toward a cap-and-trade system which would set a limit on carbon-dioxide emissions and require companies. Proponents of carbon taxes worry about the propensity of political pro-cesses under a cap-and-trade system to compensate sectors through free al-lowance allocations but a carbon tax is. With cap-and-trade units of carbon are initially given out for free meaning there is no upfront cost to firms.

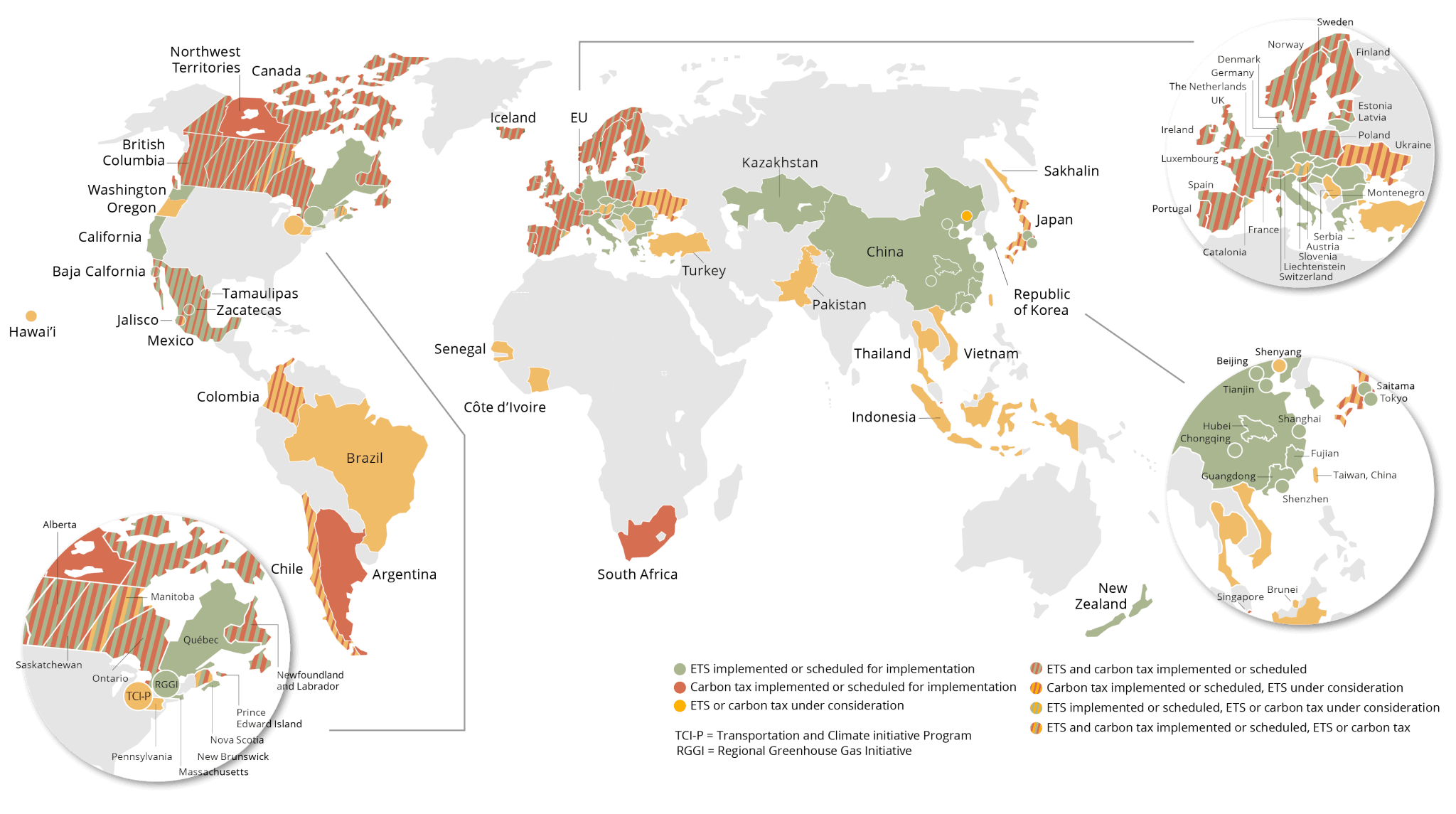

This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. A carbon tax and cap-and-trade are opposite sides of the same coin.

A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives. A carbon tax while not easy to implement across borders would be significantly simpler than a global cap-and-trade system. Peter MacdiarmidGetty Images G r.

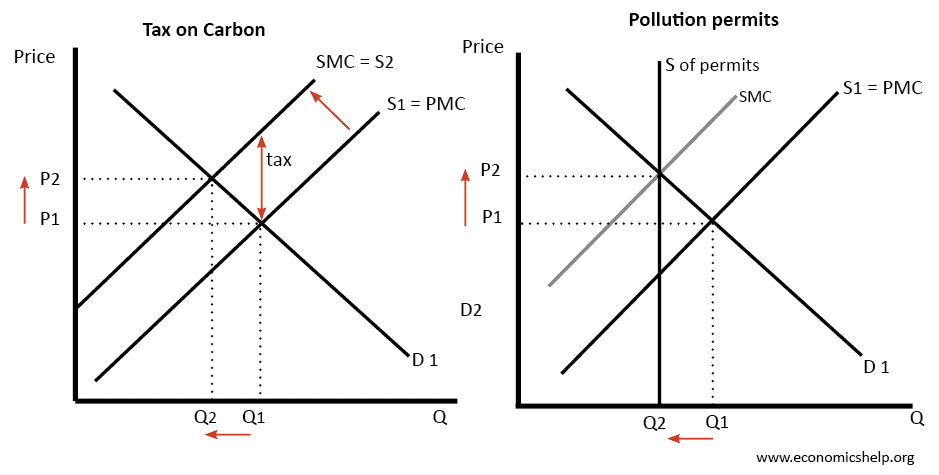

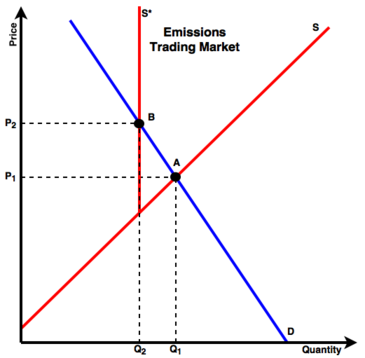

Carbon taxes and cap-and-trade schemes both add to the price of emitting CO2 albeit in slightly different ways. Carbon taxes vs. In contrast under a pure cap-and-trade system the price of carbon or CO 2 emissions is established indirectly.

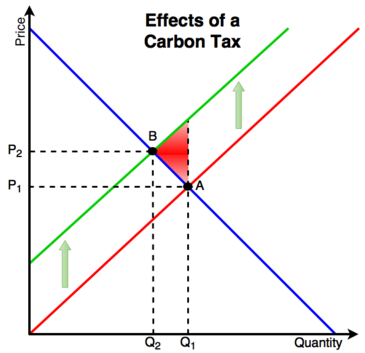

It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas emissions. With a carbon tax there is an immediate cost to. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions.

Carbon tax the price of carbon or of CO 2 emissions is set directly by the regulatory authority this is the tax rate. A carbon tax I dont know what to say about this article which is largely a critique of a grandfathered cap-and-trade system for. While a carbon tax sets the price of CO2 emissions and allows the market to determine the amount of reduced emissions a cap-and-trade system sets the quantity of emissions allowed which can then be used to estimate the decline in the rise of global temperatures.

Cap-and-Tradethe approach most popular among politicianswould put a quantitative limit on annual carbon emissions by auctioning permits that power plants and other industries would have to purchase in order to burn fossil fuels whereas a Carbon Taxthe approach most popular among economistswould discourage emissions reductions by. As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases. With a cap and trade scenario emitters have the flexibility to reduce emissions in the house or purchase allowances from other emitters who have achieved surplus reductions of their own.

In contrast cap and trade levies an implicit tax on carbon. A carbon tax sets the price of carbon dioxide. Carbon Tax vs.

Those in favor of cap and trade argue that it is the only approach that can guarantee that an environmental objective will be achieved has been shown to effectively work to protect the environment at lower than expected costs and is. A carbon tax system as the name implies forces companies to pay a fixed fee per ton of greenhouse gas emissions GHG. Cap-and-trade involves setting an economy-wide emissions limit for those sectors under regulation and issuing or auctioning off emissions permits to companies that can then be sold on secondary markets providing.

The cap aspect is where a government sets an emission cap and issues a. Each approach has its vocal supporters. In a carbon tax scenario emitters must pay for every ton of GHG they emit - thereby creating an incentive to reduce emissions in the house as much as possible to avoid the tax burden.

The regulatory authority stipulates the. Carbon Tax vs. Last year the Senate considered but defeated a cap-and-trade bill called Lieberman-WarnerThe basic idea of a cap-and-trade system is to control carbon emissions by creating a regulated.

A carbon tax is an explicit tax and Americans are notoriously tax phobic. Theory and practice Robert N. Cap and Trade.

A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a. April 9 2007 413 pm ET. Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences.

Difference Between Carbon Tax And Cap And Trade Difference Between

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Climate Change Education Across The Curricula Across The Globelesson Plan Environmental Economics Cap And Trade

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Cap And Trade An Overview Sciencedirect Topics

Carbon Trading Schemes Economics Help

Carbon Tax Vs Emissions Trading Energy Education

Cap And Trade Basics Center For Climate And Energy Solutions

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Difference Between Carbon Tax And Cap And Trade Difference Between

Carbon Tax Vs Emissions Trading Energy Education

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

Economist S View Carbon Taxes Vs Cap And Trade

Cap And Trade An Overview Sciencedirect Topics

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Difference Between Carbon Tax And Cap And Trade Difference Between